RESTRUCTURE CONSULTING

Restructuring is often the key to securing a company's long-term success. It may be necessary to respond to market changes, unlock efficiency potential, or regain financial stability. Our task is to support you during these crucial phases. With in-depth expertise and a clear focus on the essentials, we guide you through the entire process – from analysis and strategy development to implementation. Together, we create the foundation for a sustainable and future-proof corporate structure.

Restructuring a company can be an exceptionally complex process with numerous challenges. For a successful transformation, leaders often have to overcome enormous hurdles and ensure that the changes actually take effect.

Your contact at IQX:

Reinhold Trummer

+43 676 677 30 85

This email address is stez protected from spambots. You need javaScript Enabled to view it.

Operational restructuring: An indispensable component of successful restructuring projects

In times of economic uncertainty and technological change, companies often face existential challenges. To overcome crises and position themselves for future competitiveness, comprehensive restructuring is frequently unavoidable. While the focus is often on financial and strategic aspects, operational restructuring should be considered an integral part of such projects. It is crucial for ensuring that the planned changes have a profound and lasting impact on the organization. But what makes operational restructuring so essential?

Successful restructuring should not focus solely on cost reduction or improving the financial structure. It is often overlooked that many problems lie in operations, where inefficient processes lead to wasted time and resources. Operational restructuring aims to identify and eliminate these inefficiencies.

For example, outdated IT systems or manual, error-prone processes can severely hinder a company's operations. This is where operational restructuring comes in: Digitizing processes, automating routine tasks, and introducing more agile working methods can achieve significant efficiency gains. These measures not only lead to short-term cost reductions but also contribute to long-term competitiveness by creating flexibility and scalability.

In many restructuring projects, the question of competitiveness is often neglected. However, especially in a dynamic market environment, it is crucial that a company can adapt quickly to changing conditions. Operational restructuring makes it possible not only to improve internal processes but also to strengthen a company's market position.

One example of this is supply chain optimization: A company that makes its supply chains more efficient can react more quickly to fluctuations in demand and better serve its customers. This gives it a clear competitive advantage. At the same time, lean and well-coordinated production enables companies to react more quickly to market trends or technological innovations and to leverage them to their advantage.

Restructuring projects often involve the development of extensive strategic and financial plans, which, however, are only inadequately implemented in day-to-day operations. Operational restructuring ensures that the decisions made actually impact daily business and do not merely exist on paper.

For example, new management structures or cost-cutting plans could be ineffective without corresponding operational adjustments. Operational restructuring puts these plans into practice by anchoring the necessary changes in processes and structures. This ensures that the organization as a whole is able to meet the new requirements and integrate changes as part of its daily operations. This is particularly important to ensure that the restructuring is not just a short-term improvement, but has a sustainable effect.

An often overlooked aspect of restructuring projects is the role of employees. Change can generate anxieties and uncertainties, leading to resistance and a decline in motivation. However, targeted operational restructuring can actively involve employees in the change process and strengthen their motivation.

Operational changes, such as improving work processes, clarifying responsibilities, or implementing modern technologies, can make employees' daily lives easier and enable them to work more productively. When employees see that the restructuring actually benefits them and is not just an abstract management measure, their willingness to actively participate increases. In the long term, this contributes not only to an improved company culture but also to greater efficiency and quality of work.

Typically, a primary goal of restructuring projects is cost reduction. However, while financial restructuring often focuses on savings through staff reductions or site closures, operational restructuring offers a way to optimize cost structures in a more sustainable manner.

By optimizing processes and eliminating inefficiencies, companies can significantly reduce their operating costs without necessarily resorting to layoffs or compromising product quality. Lean and well-designed processes mean that resources are used more efficiently – whether in production, logistics, or administration. Examples include implementing lean management methods or automating repetitive, low-value-added tasks.

While financial restructuring can often achieve short-term successes by restructuring debt or raising capital, the question of long-term stability remains. Operational restructuring lays the foundation for sustainable business success by ensuring that the company overcomes not only financial but also structural and procedural challenges.

A company that is able to continuously improve its operational processes not only remains competitive but is also better prepared for future challenges. This can take the form of improved response times to market changes, higher customer satisfaction through optimized services, or better innovation management. In this way, operational restructuring creates space for future growth and strengthens the company's market position in the long term.

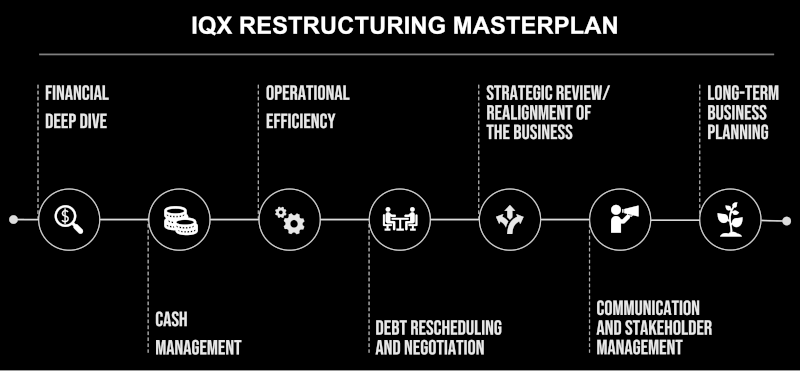

The IQX Restructuring Master Plan

Extremely important – but not quantitatively assessable – are the challenges of overcoming the “cultural resistance” and the “over-communication needs” of employees during restructuring phases.

Employees often resist change out of fear of the unknown, job insecurity, and disruption of established routines. This resistance can manifest as decreased productivity, increased turnover, and a decline in morale.

Inconsistent messaging and a lack of support from middle and lower management can exacerbate resistance. It is crucial to ensure that leaders at all levels are aligned and actively support the restructuring.

Failure to communicate the reasons for restructuring, its benefits, and its impact on employees can lead to confusion and mistrust. Transparent and frequent communication is essential to mitigate these issues.

The IQX GROUP approach to restructuring a company / individual business units (with liquidity problems) is to create a comprehensive master plan to address immediate (cash flow) problems while simultaneously laying the foundation for long-term (financial) stability.

The IQX GROUP MASTERPLAN is based on the points shown below, which of course – depending on the scope of the restructuring – may only include partial aspects.

Phases and content of a restructuring

1. "DEEP DIVE" on the financial situation

Critical examination, thorough analysis

- the annual financial statements for the last 3 years, the profit/loss statement on a monthly basis for the last 12 months

- the cash flow forecasts for the next 3, 6 and 12 months

- the debt obligations

- of the company's current assets

- the company's solvency according to legal requirements (checking the avoidance of delaying insolvency proceedings)

Comprehensive root cause analysis of liquidity problems (conducted by relevant experts from the IQX GROUP)

- excessive debt

- inefficient processes

- Product portfolio analysis (product profitability analysis)

- uncompetitive cost structures

- faulty pricing structure towards customers

- declining sales

- Market changes

- …..

Start of the preparation of a going concern forecast

2. Short-term, stringent cash management

Implementation of strict cash flow management to maintain or improve liquidity,

- the exclusive approval of each payment by the Managing Director / IQX “Chief Restructuring Officer”

- the delay of payments to suppliers in coordination with these

- the acceleration of debt collection

- negotiating extended payment terms

- minimizing all raw material, semi-finished product and finished part inventories

Prioritizing payments to critical suppliers to maintain essential deliveries and relationships

Identifying and realizing short-term financing options to meet immediate liquidity needs:

- Expansion of credit lines

- Factoring

- Consider asset-based loans

- "Sell and lease back"

- ……

Incorporation of the prepared cash flow program, including the measures taken, into the going concern forecast

3. Massive improvements in operational efficiency - RESTRUCTURING

Optimizing operations to reduce costs and improve efficiency. This can include, among other things, restructuring departments, renegotiating contracts, or outsourcing non-core functions.

Identifying and eliminating wasteful spending or redundant processes (e.g., process mining, lean office, etc.)

Implementing Lean Management principles to optimize all types of resource utilization and minimize waste -> see IQX OPEX program

Incorporation of all decided restructuring measures, including the expected improvements on company results, cash flow, etc.

4. Debt restructuring and negotiation

Intensive negotiations with creditors to renegotiate the terms of existing debts, e.g.

- to extend the terms

- to lower interest rates

- the possibility of securing a (partial) debt waiver.

Identifying and evaluating debt consolidation or refinancing options to reduce overall interest costs and improve cash flow.

Consideration of equity financing options, such as those from existing shareholders, convertible bonds, etc., to reduce the debt burden

Incorporation of all debt restructuring results and improvements in equity financing into the going concern forecast

5. Strategic review / realignment of the business

The assessment of the company's market position, competitive landscape, and growth prospects.

Identifying strengths and opportunities for diversification – with the potential for expansion in the medium term.

The valuation of underperforming assets, products, and production facilities with the aim of

- a sale

- a cessation of production

- a shutdown

Completion of the going concern forecast and submission to the creditors for acceptance

Intensive collaboration with all creditors and key stakeholders to generate approval for the going concern forecast

6. Communication and Stakeholder Management

Ensuring and maintaining transparent communication with employees, suppliers, creditors and other stakeholders regarding the company's financial situation and restructuring efforts.

Stringent monthly reporting to ensure adherence to target paths, as presented in the going concern forecast

Addressing concerns and creating a climate of trust to maintain support from all creditors and stakeholder groups.

7. Long-term business planning

Developing a viable, sustainable business model that is geared towards future market trends and customer requirements.

Developing innovations and new products to differentiate products or services from competitors and to open up new sources of revenue in the future.

Implementing robust risk management to avoid future liquidity risks and create an agile corporate structure.